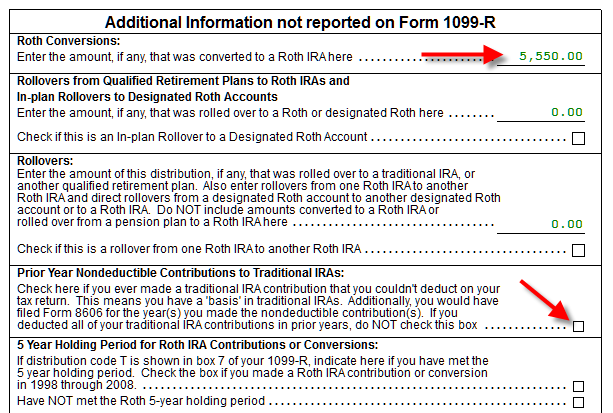

This threw me off as i thought the conversion would be under roth 2018 but the conversion did take place in 2019 so it ended up under roth 2019.

Backdoor roth ira conversion deadline 2019.

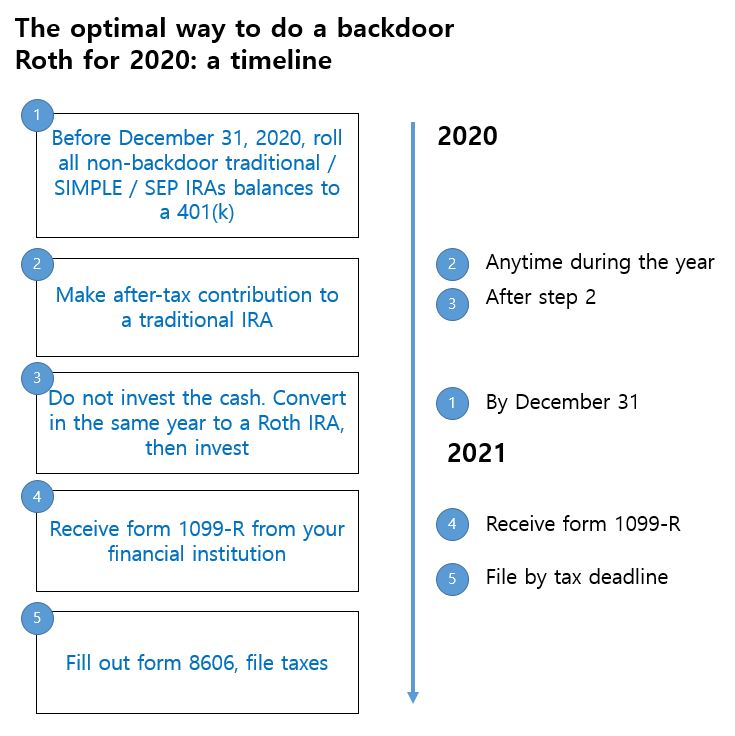

July 15 is also an important date for backdoor roth conversions for people who don t qualify for roth contributions.

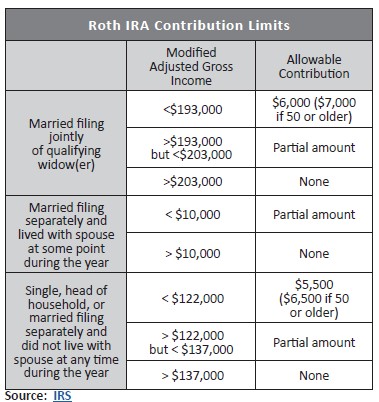

Remember to be able to fully contribute to a roth ira you have to meet the following income limits as of 2019.

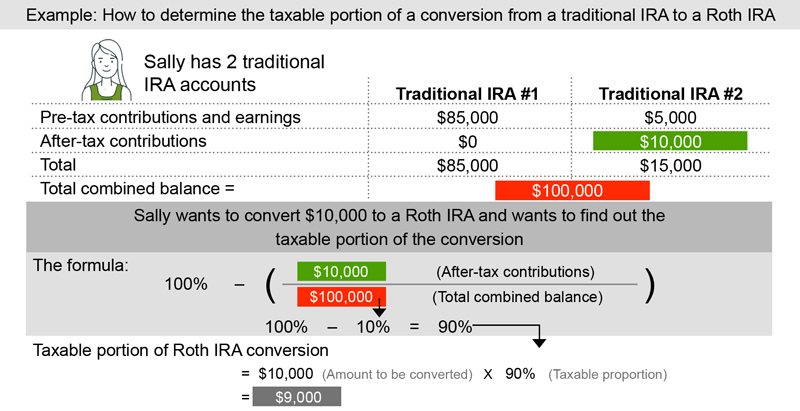

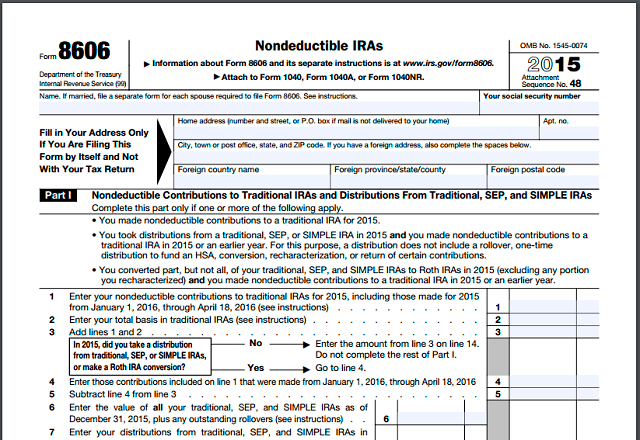

The conversion is reported on form 8606 pdf nondeductible iras.

Use the checklist below for your account types or call 800 343 3548 to start the process.

Return to iras faqs.

I was worried that when i contibute 6000 to 2019 tira then convert to roth it would hard stop me for going over the 2019 roth contribution limit.

Here s why you may want to reconsider doing that backdoor roth ira conversion published.

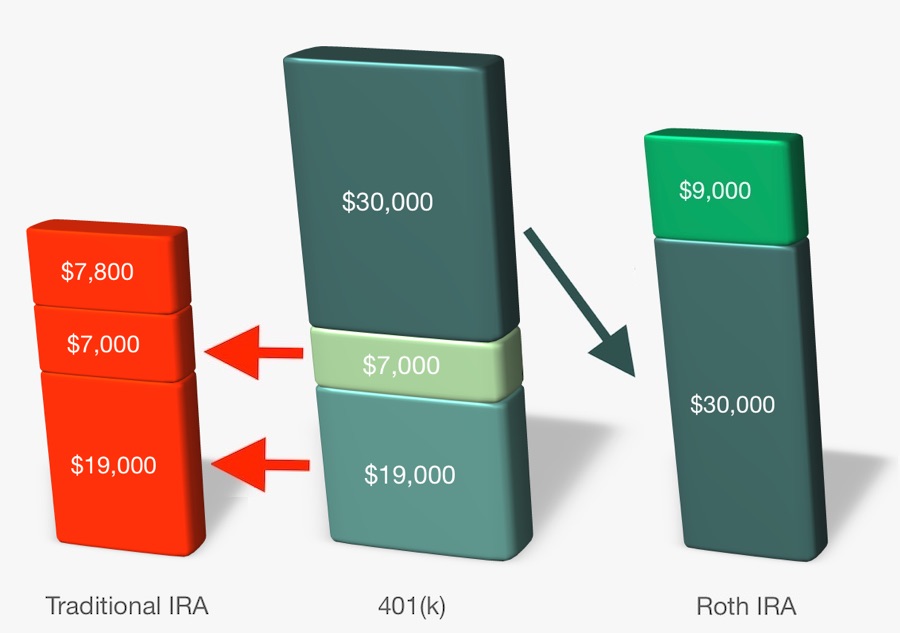

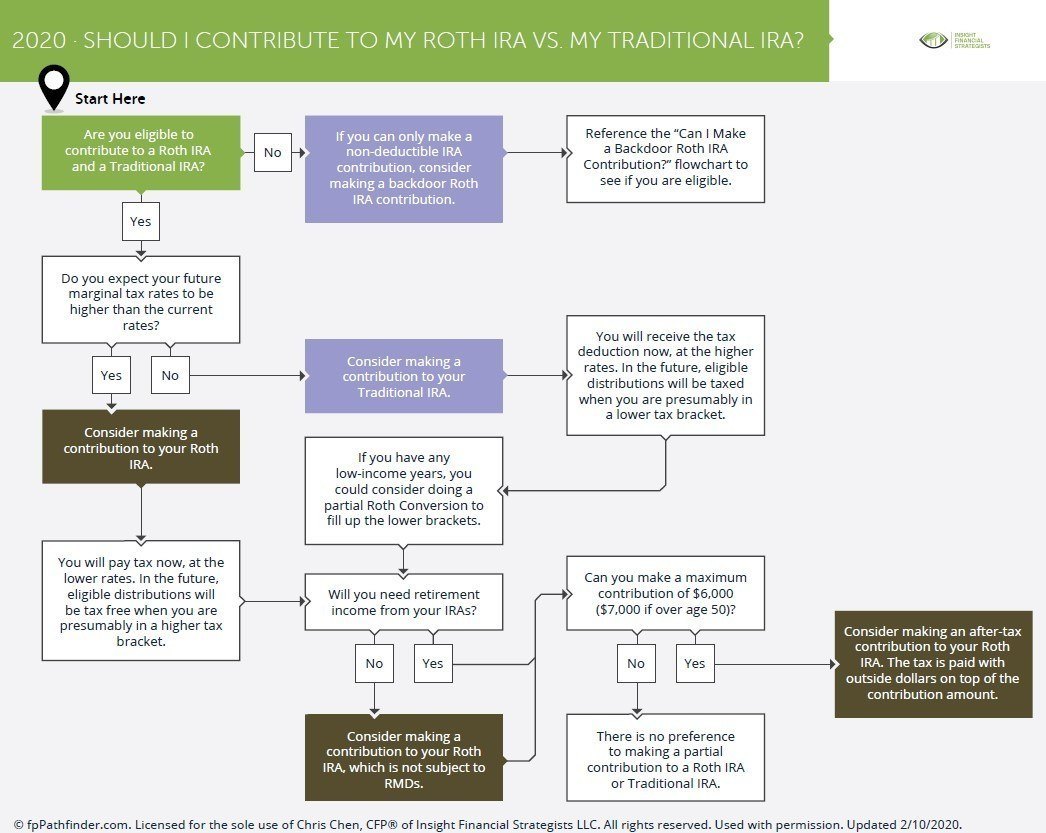

A backdoor roth ira can make sense in the same scenarios any roth ira conversion makes sense.

A conversion to a roth ira results in taxation of any untaxed amounts in the traditional ira.

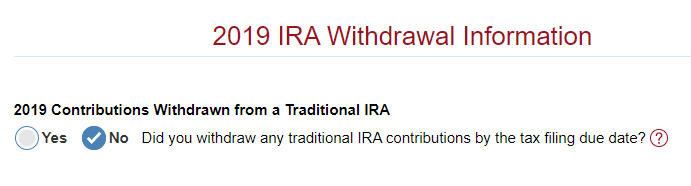

December 31 2019 for the 2019 tax year.

The deadline for executing a roth ira conversion for a given tax year is dec.

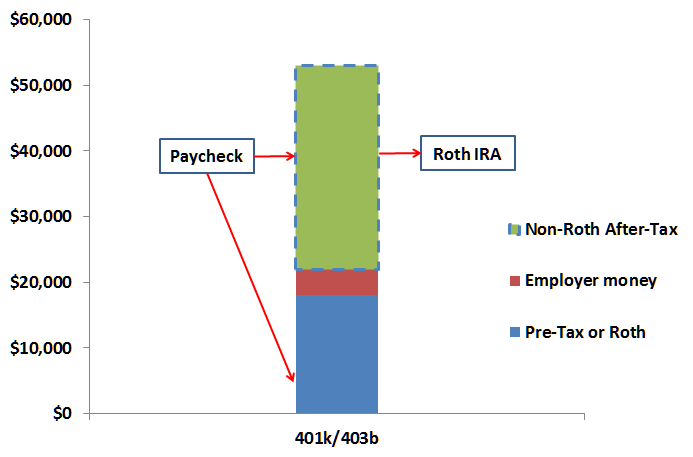

From there a roth ira conversion takes place letting those high income investors take advantage of tax free growth and future distributions without having to pay income taxes later on.

A method that taxpayers can use to place retirement savings in a roth ira even if their income is higher than the maximum the irs allows for regular roth ira contributions.

This can cause some confusion since you generally have until april 15 of the following year to add.

That is if you haven t made your 2019 ira contribution and you don t qualify for a roth contribution due to income limits consider doing a backdoor roth for 2019 and while you.

Roth ira income limits if your annual income is low enough you may.

Last week we talked about this year s july 15 deadline for 2019 ira contributions.

Steps in converting to a roth ira.

April 23 2019 at 10 16 a m.

The backdoor roth ira conversion is an indirect way to contribute to a roth ira when you are not eligible to contribute directly due to high income.

31 of that year.