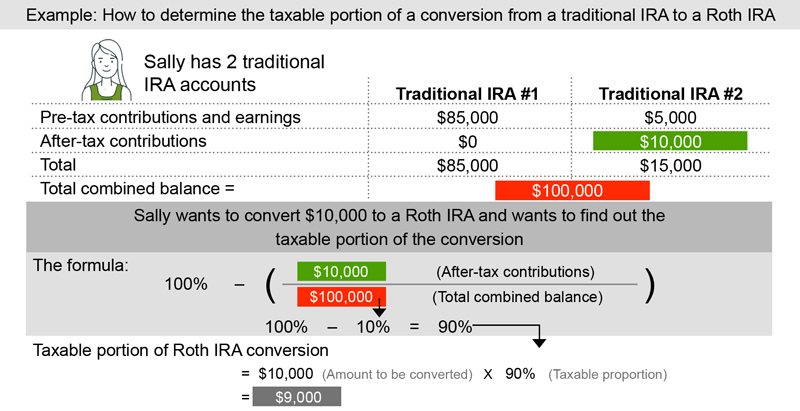

For instance if i roll my private ira into a company 401k today 1 11 2018 will i be able to star the back door roth strategy once that roll over is done guessing around 1 18 2018.

Back door roth ira rules 2018.

A method that taxpayers can use to place retirement savings in a roth ira even if their income is higher than the maximum the irs allows for regular roth ira contributions.

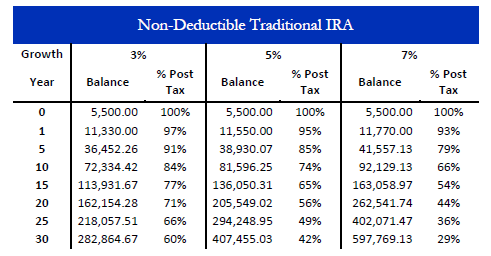

For 2018 the ability to contribute to a roth ira begins to phase out for singles with a modified adjusted gross income of 120 000 and it gradually fades out to where you can t contribute to a.

The backdoor roth ira.

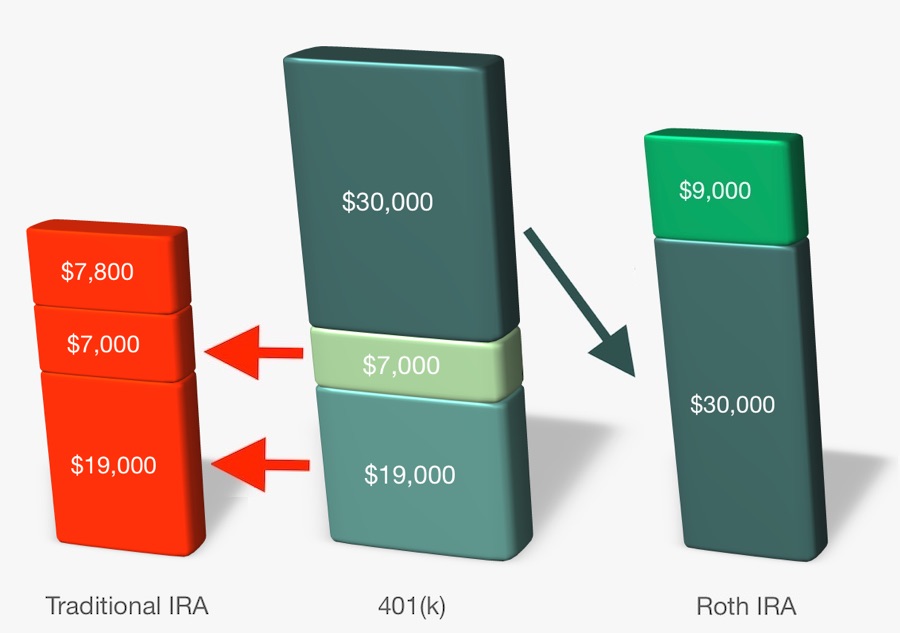

The back door roth is a work around that lets people move.

The annual limits for contributing directly to a roth.

In 2018 the ability to make contributions to a roth ira begins to phase out for.

For 2018 individuals cannot make a roth ira contribution if their income exceeds 199 000 married filing jointly or 135 000 single.