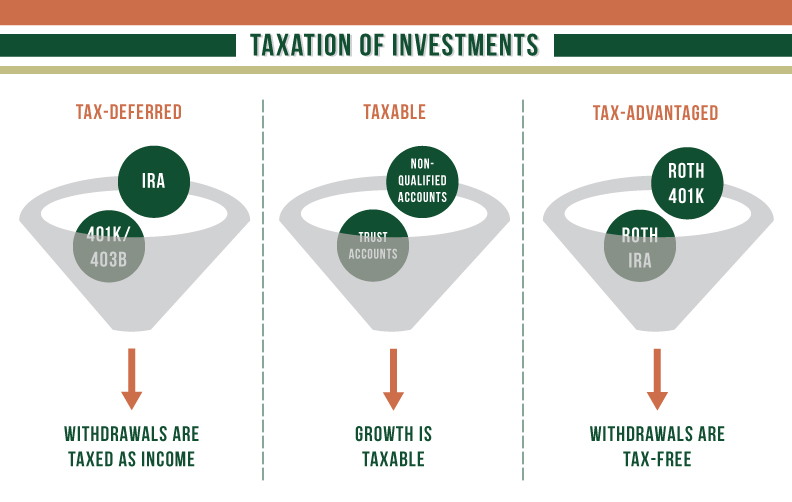

A method that taxpayers can use to place retirement savings in a roth ira even if their income is higher than the maximum the irs allows for regular roth ira contributions.

Back door roth ira contribution 2018.

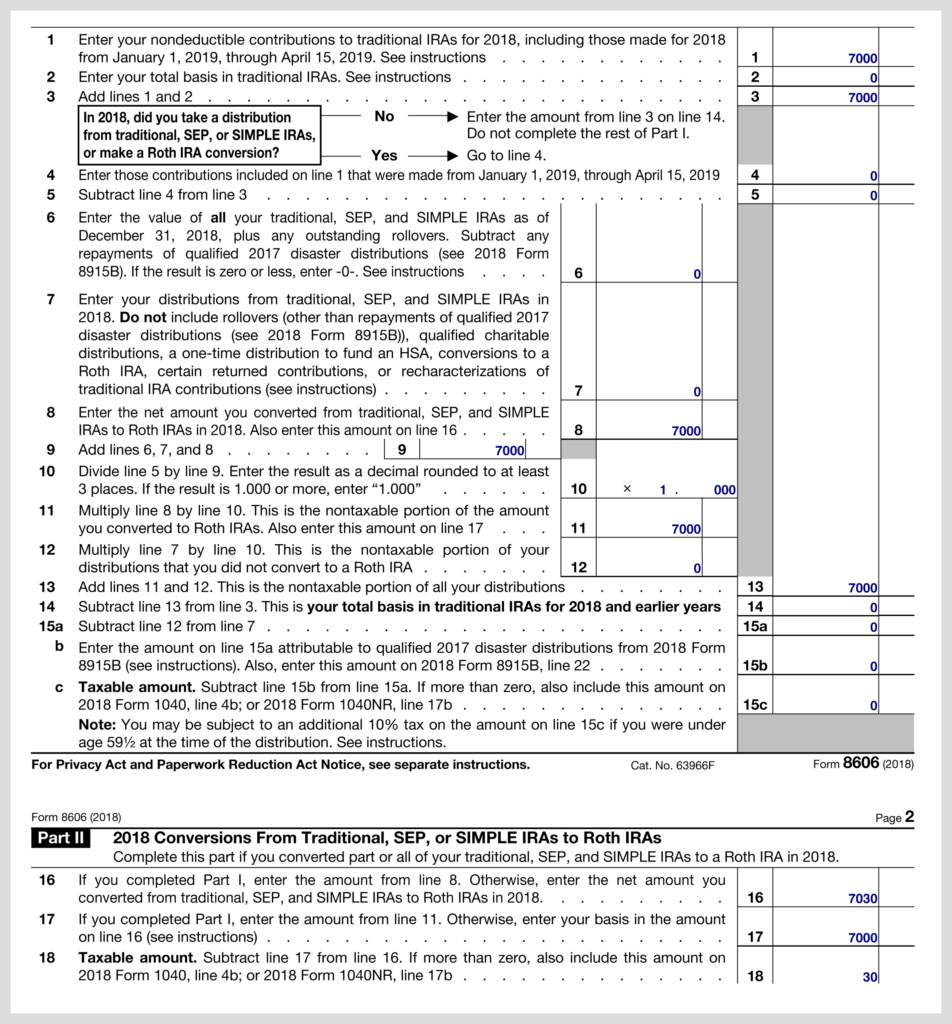

Those over 50 can contribute 6 500 7 000 in 2019.

A roth ira conversion made in 2017 may be recharacterized as a contribution to a traditional ira if the recharacterization is made by october 15 2018.

The problem with roth iras.

In general if you have earned income from work then you can make an ira contribution.

A roth ira conversion made on or after january 1 2018 cannot be recharacterized.

You have until april 15 2019 to contribute to a roth ira for 2018.

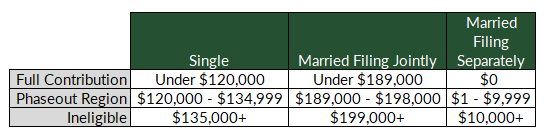

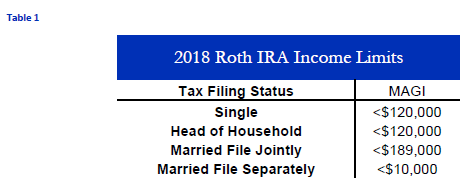

Taxpayers with higher incomes don t qualify to contribute to a roth ira directly.

If you are under 50 you can contribute 5 500 per year 6 000 in 2019.

The backdoor roth ira contribution is a strategy and not a product or.

135 000 or more if your tax filing status is single.

How long do you need to wait after rolling a private ira into a solo 401k or a company 401k before you can use the back door roth strategy.

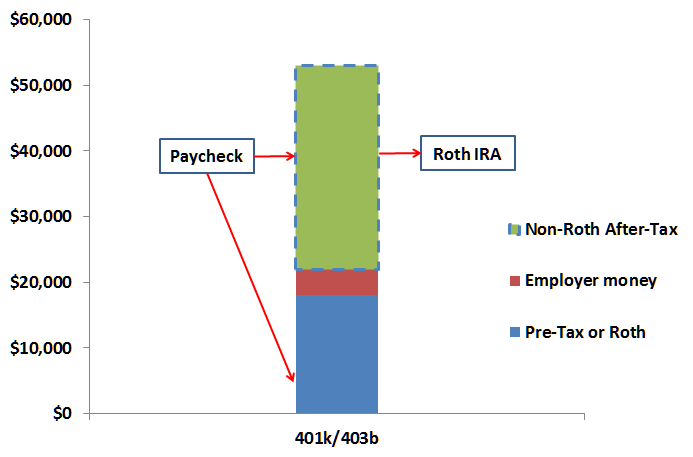

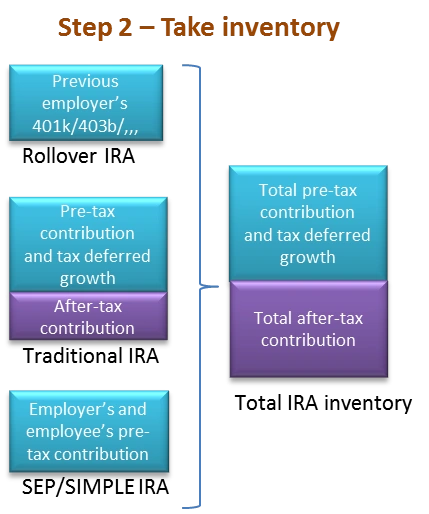

You can use a back door roth ira by completing these steps.

Step one is to make a contribution to a traditional ira.

Make a nondeductible contribution to a traditional ira.

If you re one of these people you can still use a roth ira account by using what s known as a back door roth ira.

Why a roth conversion or backdoor roth ira is a good idea in 2018 september 19 2018 by kathleen coxwell doing a roth conversion also known as a backdoor roth ira is perhaps even more appealing in 2018 than ever before.

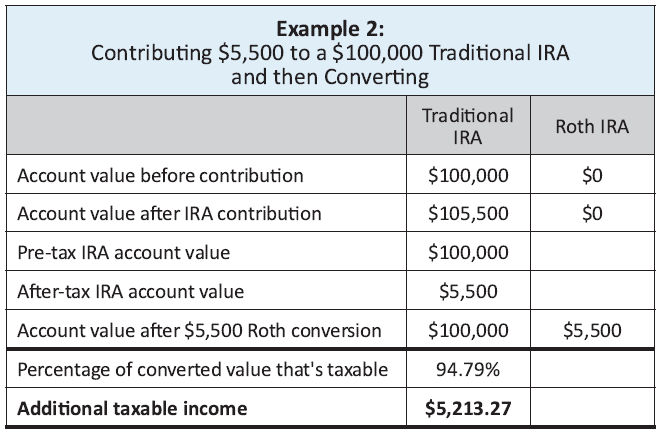

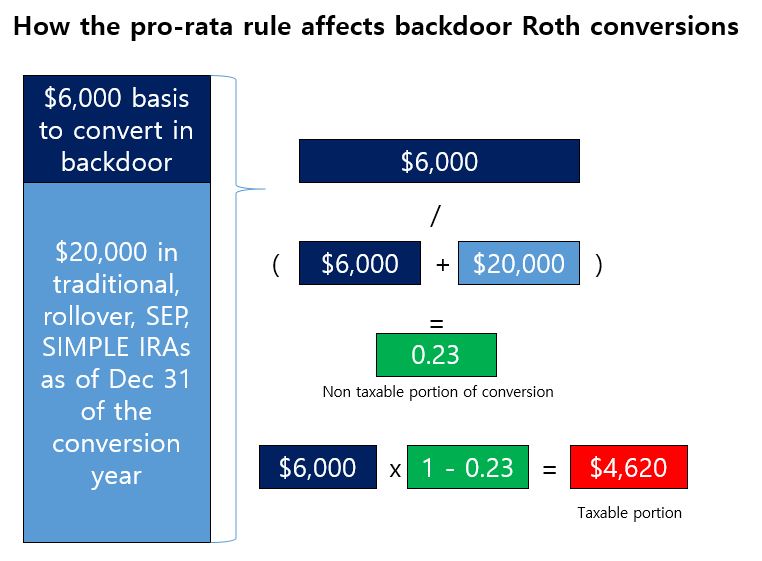

But if you earn more than the cutoff and you want to make a back door roth contribution it s important to consider the total.

The two steps to a backdoor roth ira contribution.